We don’t sell services—we deliver outcomes

Every engagement is milestone-based, benchmark-aligned, and focused on improving your:

HCAHPS & CMS Ratings

Conduced market research and user analysis to understand customer needs and industry trends.

Value Based Reimbursement

Conduced market research and user analysis to understand customer needs and industry trends.

EMRAM

Conduced market research and user analysis to understand customer needs and industry trends.

Patient Loyalty & Brand Retention

Conduced market research and user analysis to understand customer needs and industry trends.

Margin & Cost Optimisation

Conduced market research and user analysis to understand customer needs and industry trends.

Why U.S. Healthcare Choose Us.

“Empathyfi is a next-generation experience platform that harnesses the power of empathy to strengthen brand equity, elevate user experiences, and drive retention through lasting loyalty.”

ROI Focused

Advance Brand Experience Solutions

Our services are built to drive measurable outcomes—boosting brand loyalty, operational efficiency, and emotional engagement that translates into sustained business growth.

EMRAM Savvy

Advance Brand Experience Solutions

Bridge the digital gap with confidence. We optimise organization performance and cost using our unique approach of empathy mapping for efficient, timely and scalable operations.

PX-First, Revenue Smart

Crafting intuitive experiences tailored to real human needs. Balance empathy with efficiency.

Modular & Strategic

Empowering decision through data, research and realtime analytics. Tailored to your exact need

COMPARISON

Action Driven Comparison with our different approaches

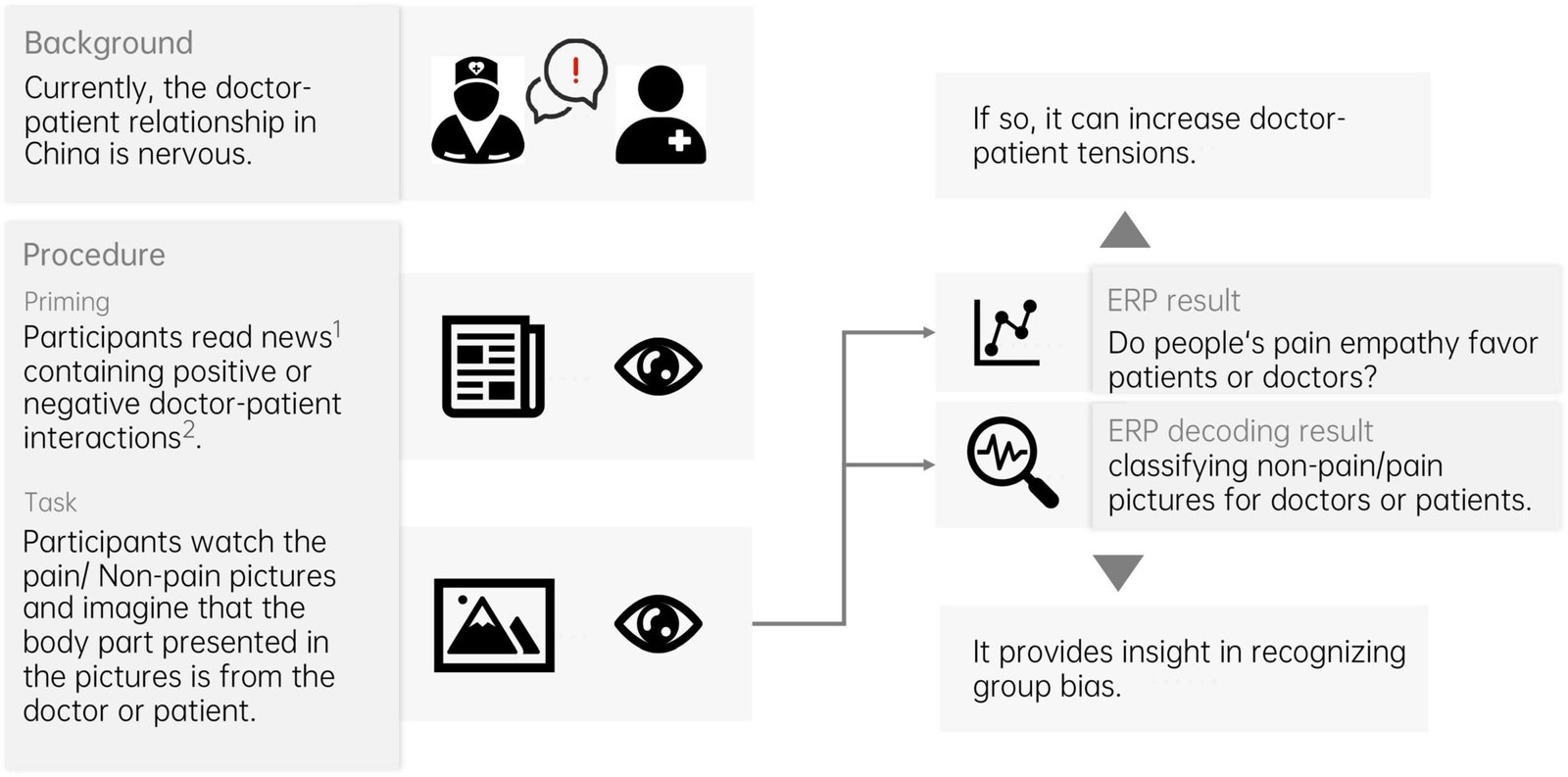

User Empathy Mapping

We map end-to-end patient and caregiver experiences to uncover emotional, clinical and operational gaps across healthcare operations.

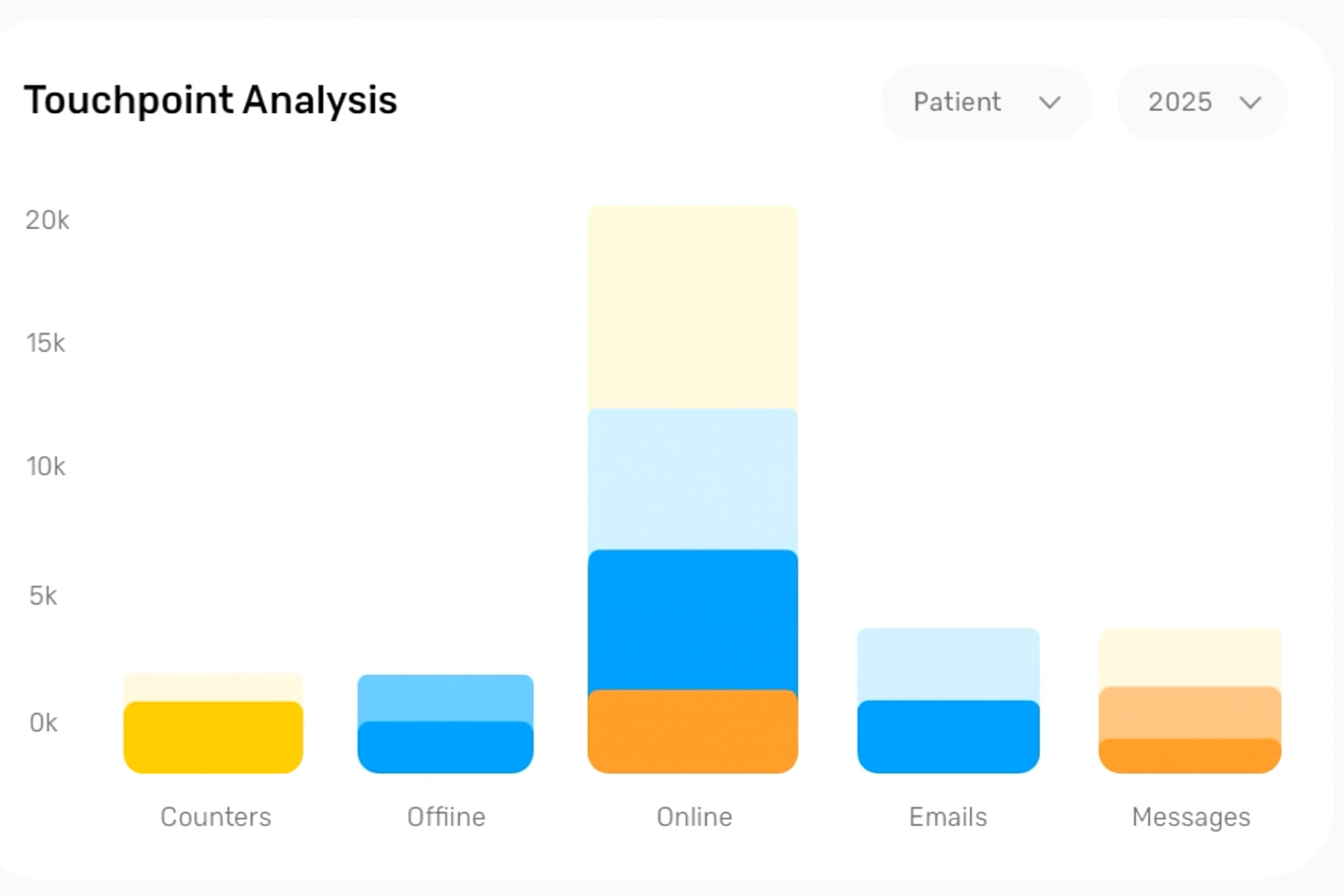

Touch Point Analysis

We evaluate key interactions—digital, physical, and human—to identify where trust is gained, lost, or needs reinforcement.

Blue Print Co Creation

We co-create actionable experience blueprints with staff and patients to align services with human-centered care expectations.

COMPARISON

Outcome Driven Comparison with our different approaches

Empowering healthcare with tools to better connect with users.

We empower brands to craft unforgettable customer experiences. As experience enhancers, we blend empathy, strategy, and smart design to turn every interaction into loyalty, every touchpoint into trust, and every moment into measurable impact.

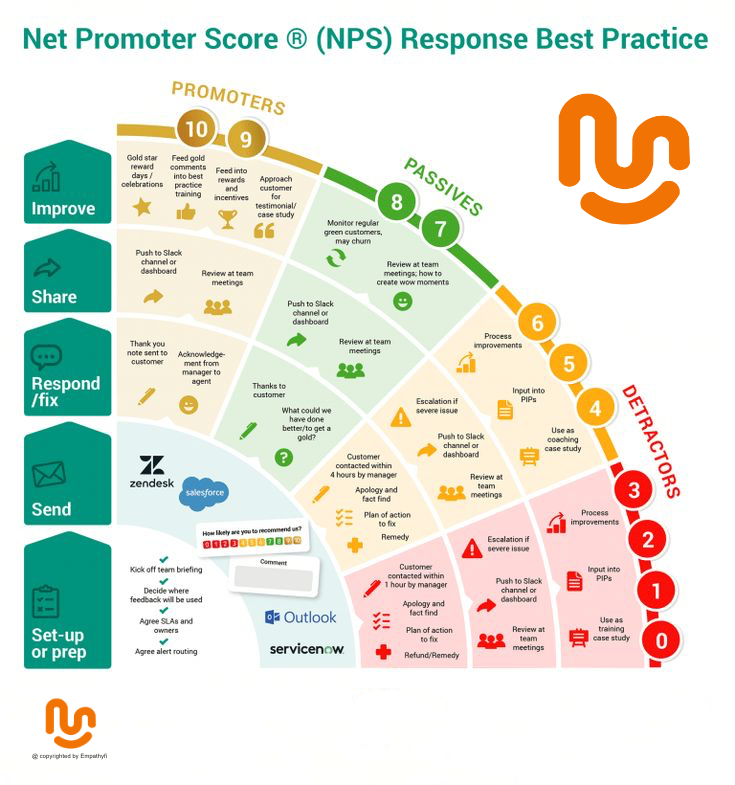

BrandScore

With BrandScore, we assess how your brand connects emotionally and experientially with users—delivering clear, data-backed insights to strengthen loyalty, sharpen strategy, and maximize ROI.

COFLET Benchmarking

COFLET Benchmarking unites every critical lever in healthcare—delivering sharp, actionable benchmarks that fine-tune each segment and unleash maximum value, performance, and impact across the board.

Analytical Maturity (EMRAM)

By identifying real gaps and value-creating features, we drive digitalization that’s user-friendly, cost-efficient, and emotionally intelligent—enabling caregivers to focus on care, while patients feel truly seen and supported.

Customer Loyalty Index

Our Customer Loyalty Index goes beyond satisfaction—measuring emotional connection, repeat behavior, and brand advocacy to give you clear, actionable insights that fuel retention, elevate trust, and drive sustainable growth.

Committed to your Success

Boost impact with flexible add-ons—solo or bundled. We deliver tailored, reliable support to strengthen emotional connections, enhance efficiency, and build lasting brand loyalty.

Branding with Empathy Mapping

Local Influencer Activation Campaign

What it does: Builds Community trust using real patients, staff or caregiver as local brand ambassadors.

Experience-Centered Marketing Toolkit

What it does: Creates storyboards, campaign ideas, and content frameworks that reflect real user journeys and emotional drivers

Brand Refresh & Messaging Kit

What it does: Refines your voice, tone, and visuals to reflect empathy, trust, and modern care values.

Staff Empathy & Experience Training

What it does: Delivers bite-sized learning to improve staff-patient connection and frontline behavior.

Employer-Brand Alignment Sprint

What it does: Aligns internal culture, recruitment narratives, and staff behavior with your brand promise to patients.

Value-Based Readiness Booster (EMRAM/CMS)

What it does: Offers a fast-track review and advisory plan for improving HCAHPS, EMRAM, and VBR-linked experience metrics.

Operation with Staff Empathy

Custom PX + ROI Dashboards

What it does: Tracks NPS, loyalty, and performance metrics visually via Airtable, Looker Studio, or Tableau.

Patient Voice Integration (PX Panels)

What it does: Curates real patient advisory panels to co-create and validate experience strategy.

Patient Loyalty & Retention

Discharge & Follow-Up Optimization Kit

What it does: Redesigns discharge scripts, checklists, and outreach touchpoints to improve retention and reduce readmissions.

Need more flexibility in empathy transformation of your business?

Have Questions?

Linear Funnel vs. Behaviour Funnel?

| Feature | Linear Funnel | Behavior Funnel |

|---|---|---|

| Structure | Fixed, sequential | Flexible, based on user actions |

| Flow Assumption | One-way, top to bottom | Multi-path, can loop or skip stages |

| Use Case | Conversion tracking | Understanding real user behavior |

| Insights Provided | Where users drop off | How users behave, hesitate, or retry |

| Best for | High-level performance tracking | UX design, empathy mapping, optimization |

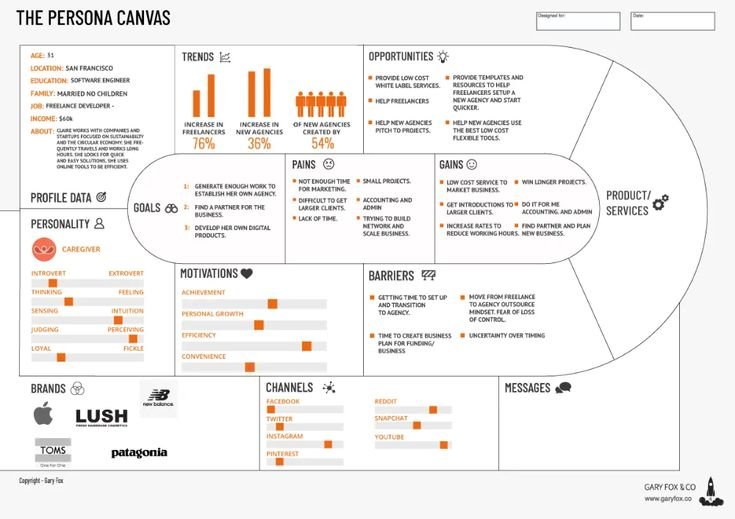

Types of Persona in Hospital?

🔹 Primary Personas (High Impact)

-

Inpatients – admitted for surgery, maternity, chronic illness, etc.

-

Outpatients – visiting for consultations, diagnostics, day procedures.

-

Emergency Patients – high-stress, time-sensitive needs.

-

Family/Caregivers – emotional, logistical, financial involvement.

-

Physicians/Consultants – care providers with authority and pressure.

-

Nurses – frontline caregivers, balancing clinical and emotional roles.

-

Administrative Staff – admission, billing, records, scheduling.

-

Technicians – diagnostic, imaging, lab support.

-

Facility/Maintenance Staff – indirect but crucial to experience.

-

Hospital Management – policy, culture, operations.

🔹 Secondary Personas (Contextual or Specialized)

-

Medical Students/Residents – learners, observers, hands-on.

-

Insurance/TPA Representatives – coverage decisions, documentation.

-

Volunteers – emotional support, logistics, community engagement.

-

Discharge Coordinators/Social Workers – continuity, rehab, post-care.

-

Pharmacists – medication communication, counseling.

-

Security Staff – safety perception, access control.

-

Public Healthcare Beneficiaries (e.g., ESIC, Ayushman) – low-income, government scheme users.

🧠 Strategy Tip:

Empathy maps can be grouped around three lenses:

-

Care Experience Personas: Patient, caregiver, clinician

-

Operational Personas: Admin, billing, support staff

-

Influence Personas: Regulators, insurers, vendors

You don’t need to map all at once. Start with top 5–7 based on the project goal (e.g., improving inpatient experience or streamlining OPD flow), then iterate.

Milestone Vs. Outcome Approach?

Summary Comparison

| Aspect | Milestone-Based | Outcome-Based |

|---|---|---|

| Payment Trigger | Deliverables or stages | Results or impact |

| Risk | Shared, but consultant earns regardless of outcome | Higher on consultant; client pays for success |

| Trust Level | Moderate | High (requires strong partnership) |

| Best For | Defined scopes, phased delivery | Transformative, performance-driven projects |

What Benchmark we help our client achieve?

Benchmarks for Service Impact Areas

🏥 Branding & Loyalty (PX/NPS/Retention)

| Metric | Current U.S. Benchmark | Target to Aim For |

|---|---|---|

| Net Promoter Score (NPS) | 30–40 (avg health systems) | 50+ (leaders like Cleveland Clinic, Mayo) |

| Patient Retention Rate | ~60–70% | 80–90% with loyalty program |

| Out-of-pocket revenue growth | 5–8% YoY | 10–15% with brand equity & PX investments |

| New patient acquisition cost | $300–500 | Reduce by 20–30% through brand loyalty & word-of-mouth |

📈 COFLET Benchmarking (Clinical & Financial Lens)

COFLET’s 10-point framework allows you to audit the following impact zones:

| Focus Area | National Averages (U.S.) | Goal for Improvement |

|---|---|---|

| Cost per discharge | $10,000–14,000 | Lowered by 8–12% |

| Length of stay (LOS) | 4.5–6 days | Target <4 days |

| Readmission rate (30-day) | 15–17% | <12% |

| Cost-to-charge ratio (CCR) | 0.25–0.30 | Improve toward 0.20–0.24 |

| Operating margin | 2–4% | >6% after optimization |

💻 EMRAM 7.0 & Tech Maturity

| Stage | Description | % of U.S. Hospitals |

|---|---|---|

| Stage 3–4 | Basic clinical documentation, CPOE | ~45–50% |

| Stage 5–6 | Closed loop medication, physician engagement, CDS | ~30–35% |

| Stage 7 | Fully paperless, HIE, advanced analytics | ~5–7% only (top systems) |

Your goal: Move clients from Stage 3–5 to Stage 6–7 within 12–18 months with advisory & roadmap.

🧠 Empathy Mapping & PX Design Benchmarks

| Metric | U.S. Average | Target with Your Program |

|---|---|---|

| HCAHPS Overall Rating (9 or 10) | 70–75% | >85% |

| Communication with Nurses | 78% | >90% |

| Responsiveness of Staff | 65–70% | >85% |

| Patient-reported empathy | Often anecdotal | Add structured empathy KPIs & improve by 20–30% |

What KPI do we establish for our clients?

KPI Benchmarks You Can Expect

| Metric | U.S. Average | With Our Programs |

|---|---|---|

| Net Promoter Score (NPS) | 30–40 | 50+ |

| Patient Retention Rate | 65–70% | >85% |

| Operating Margin | 2–4% | >6% |

| Readmission Rate | 15–17% | <12% |

| EMRAM Stage | Stage 3–4 | Stage 6–7 in 12–18 mo |

📈 Benchmarked against top-quartile hospitals, CMS, and EMRAM standards.

Why is our Milestone-Based Payment Plan the most popular?

✅ Milestone-Based Payment Plan (Suggested for U.S. Hospitals)

| Phase | Milestone Description | Deliverables | Payment (% of total) |

|---|---|---|---|

| 1. Discovery & Buy-In | Initial Assessment & Strategic Alignment | Stakeholder workshops, baseline report on branding, tech maturity, empathy mapping, financial & operational benchmarks (COFLET) | 20% |

| 2. Benchmarking & Audit | In-depth COFLET audit & gap analysis against top quartile benchmarks | Custom COFLET dashboard, risk & opportunity matrix, benchmark comparisons | 20% |

| 3. Experience & Loyalty Design | Empathy mapping, PX journey mapping, loyalty funnel, brand DNA articulation | Journey maps, segmentation, loyalty strategy, brand messaging playbook | 20% |

| 4. EMRAM/Tech Roadmap | EMRAM maturity alignment & digital transformation strategy | EMRAM readiness score, action roadmap to Stage 6/7, integration advisory (EHR/CRM/surveys) | 20% |

| 5. Outcome Launch & ROI Tracking | Post-implementation impact tracking with ROI dashboards | Before/after KPIs, patient NPS change, revenue/per patient uplift, dashboard setup | 20% |

💡 Use payment triggers like executive signoff, delivery of specific reports, or quantifiable indicators (e.g. baseline survey conducted, EMRAM score validated).

Why is choose our Outcome-based Payment Model?

🔄 Outcome-Based Payment Model

We believe in shared success — that’s why you pay only when you see progress.

| Milestone | Deliverables | Payment |

|---|---|---|

| 1. Discovery & Buy-In | PX & COFLET Baseline, Strategy Workshops | 20% |

| 2. Deep Benchmark Audit | Custom Dashboard, COFLET Analysis, Brand Gap Report | 20% |

| 3. Strategy & Design | Loyalty Funnel, EMRAM Roadmap, Brand Messaging | 20% |

| 4. Tech + Ops Integration | EMRAM Playbook, Digital Toolkits, Staff Training | 20% |

| 5. ROI Monitoring | NPS/Retention KPIs, Revenue Uplift Dashboards | 20% |

What is Optional Bonus?

🔹 Optional Performance Bonus:

If your NPS improves by 15%+, a $10K success bonus applies.

🔹 Ongoing Retainer (Optional):

$8,000/month for continuous strategy support, PX monitoring & tech evaluation